Download the PDF of this guide

KEY CONTENT

- Why public liability insurance is so important

- What to look for in a policy

- Things to consider depending on your setting

- Insurance jargon buster

- Understand the most common claims and accidents

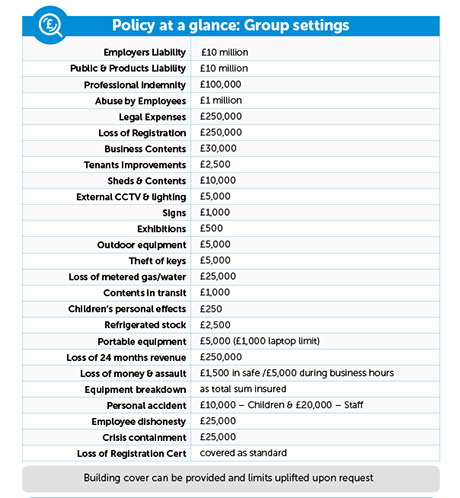

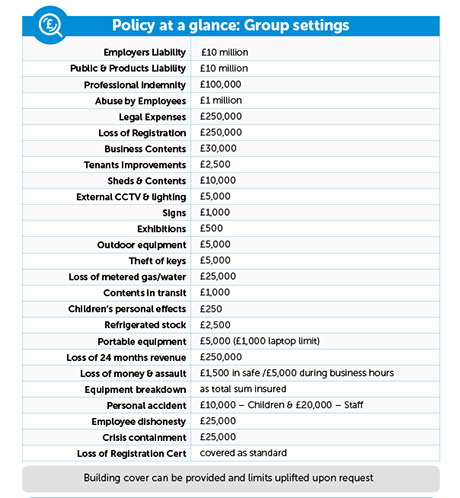

- Policies at a glance

Why is public liability insurance important

All registered childcare settings, including nurseries, pre-schools, childminders and nannies, are required by law to have public liability insurance (PLI) to cover them in their work with children. It makes sense, because accidents can happen in any setting, however well-run it might be.

Public liability insurance covers you for claims made against you by a third party while in the process of delivering the services you are contracted to deliver. Reassuringly, this means that if a child in your care injures themselves, and you are found to be responsible, any damages you may have to pay are insured for, and money is available to cover the claim providing the policy limit is sufficient.

And because the care of children is so valuable, and the children’s safety and welfare are absolutely paramount, PLI for childcarers needs to be suitable and comprehensive, with a large enough limit to cover you for most eventualities. Good insurance cover, from a reputable provider, means you and your customers – the families you support – are protected, even from very large claims. PLI gives you, and the parents of the children you care for, peace of mind.

What should you look for in a policy?

If you are shopping around for your public liability insurance, you need to carefully consider whether the cover offered by an insurer or broker is appropriate for you.

Some policies appear to offer excellent value for money, or are even offered free with another purchase, but when it comes to claims they might have limits as to the amount they pay out that are too low, and you could find yourself facing hefty bills. Even worse, you may find you are not operating legally.

If your insurance, for example, doesn’t cover you for what you consider to be day-to-day childcare practices, such as outdoor play or using trampolines, letting the children do these activities would invalidate your cover. Always check the policy summary and wording to make sure you are able to continue to do the things you do in your setting. Not all businesses are exposed to the same risks so it’s always worth making sure that you carry out regular risk assessment and that the cover you take out is tailored to the particular needs of your childcare business.

Policies are available on the market that offer varying indemnity limits, from as little as £2 million. Yes, £2 million sounds like a large amount, but a young child who has suffered a very serious accident in a childcare setting could be awarded a multi-million pound sum to support them for the rest of their lives. Check what is expected by your local early years team too, especially if you are providing funded places. Some local authorities require you to have a minimum level of cover not provided as standard by some policies.

If you employ staff, or have volunteers or students at your setting, you are required by law to have Employers’ Liability Insurance. An insurer will need to know how many people you employ, and may charge a higher premium for additional staff members.

Remember that you have an income through the running of the setting and the loss of income for the business can be protected in the event of loss or damage that may stop you being able to operate, including allegations made against a setting that force you to close. Look for policies that include either Legal Defence Costs or Legal Expenses as these can make up a significant proportion of a claim.

Other things to consider:

Nurseries, pre-schools and playgroups

- When running a setting away from your domestic premises it is important to consider risks other than PLI and ELI.

- It is probable that you will own contents within the setting and you may even own the building itself, so you will want to ensure that you have adequate protection against any loss or damage.

- In addition there will be other covers to consider such as; Abuse by Employees, Legal Expenses and Outdoor Equipment and it is important to ensure you have an insurance contract in place that extends to cover these important risks to the business.

Other things to consider:

Childminders and childcare on domestic premises

- Different PLI policies can cover anything from a lone childminder, to a childminder and up to two assistants/students. If there are more staff at a setting, further cover can be arranged, dependent on the insurance broker/provider. If you are a Limited Company, or are registered in England as Childcare on Domestic premises, please make sure you are adequately covered under your policy.

- If you provide additional services, check to make sure these are covered as part of your policy:

- Occasional crèche facilities while operating away from your own business premises (home) and with children who are not under your normal charge

- Babysitting services

- Attendance at Forest Schools

Other things to consider:

Nannies and home childcarers

- If you work together with another Nanny or Home Childcarer at the same address, check to make sure your policy covers this working arrangement.

INSURANCE JARGON BUSTER

Public liability insurance is designed for professionals who interact with customers or members of the public. As a registered childcare provider, it protects against claims of personal injury or property damage that a child or parent suffers (or claims to have suffered) as a result of your business activities where you are found to be negligent.

EMPLOYER’S LIABILITY INSURANCE (ELI)

Most employers are legally obliged to take out an employers’ liability insurance policy. It can pay compensation costs and legal fees if an employee or ex-employee sues for illness or injury caused by their work.

PROFESSIONAL INDEMNITY INSURANCE (PII)

Professional indemnity insurance is an important cover for businesses that give advice or provide a professional service to clients. As a childcare provider, it can pay for compensation claims and legal fees that may arise if you suffer a financial loss following any advice provided in connection with your service as a childcare provider.

EXCESS

An excess is the amount of money you pay towards a claim for loss of, or damage to, your property, regardless of who’s to blame for the incident. It is deducted from the claim settlement amount.

LIMIT OF INDEMNITY

An indemnity limit is the maximum amount that an insurer will pay out for any one claim and usually within any one policy year.

COMMON CLAIMS

Falls

Strike/step on – where a child has been bumped into by another child or trapped fingers in a door or collided with another child while playing

Slip/trip

Lifting/handling – where a child has dropped something on themselves or been hit by a gate or something similar

Trampoline/play equipment injuries

(from Jelf data)

An average of 62 children under the age of five die each year as a result of an accident

Falls account for the majority of non-fatal accidents while the highest numbers of deaths are due to fire (from the Consumer Safety Unit, 24th Annual Report, Home Accident Surveillance System, London, Department of Trade and Industry, 2002)

There have been at least 30 deaths across the UK due to looped cords since 1999 (14 of which have occurred since the start of 2010)

(from the British Blind Association and ROSPA. UK Public Health Blind Cord/Chain Safety Working Group, August 2014)

COMMON ACCIDENTS

- Each day around 40 under-fives are rushed to hospital after choking on something, or swallowing something dangerous

- Food is the most likely cause, but small objects and toys can also be risky for young children

- Falls are one of the most common causes of childhood accidents

- In 2008-09 over 16,000 under-fives were admitted to hospital after a fall

- Asphyxia (which also includes choking and strangulation) is the third most common cause of child accident deaths in the UK

- Most of these accidents happen to children under five

(From the CAPT website)

POLICY AT A GLANCE: childminders and nannies

- Public liability

- Employer’s liability

- Legal defence costs

- Professional indemnity

Covered as standard:

- one childminder and up to two assistants/students

- caring for a child who has;

- additional or complex needs

- allergies

- requirements for medicine to be administered

- the use of;

- trampolines

- fire pits

- bouncy castles

- soft play equipment

- forest school activities

- tree climbing

- tyres and drain pipes as play equipment

- occasional crèche facilities

- babysitting services

- loss of Registration Certificate

JELF AND PACEY: providing you with great cover

With over 40 years’ experience in the early years sector, PACEY (the Professional Association for Childcare and Early Years)understands that running a childcare setting can be a challenge. The extension of free childcare hours for parents and reduced levels of support from the government can put pressure on your running costs and time.

That’s why we partnered with Jelf, the award winning expert in business insurance, to offer policies for all forms of early years group settings that are easy to understand, simple to manage and protect your business. It has worked with an insurer to create a specialist and comprehensive insurance product that can be tailored to meet your setting’s needs.

This Guide to has been produced by Nursery World for Jelf in association with PACEY

Jelf: Jelf.com/groupsettings

Jelf: Jelf.com/groupsettings

Tel: 01793 714412

facebook.com/jelfuk/

twitter.com/jelf_uk

PACEY: pacey.org.uk

facebook.com/paceylocal

twitter.com/PACEYchildcare